197 days to go: applying investor feedback to my financial model and valuation

A recap of week six as a full-time Founder

Hey there 👋🏾,

For those of you who are short on time, here are the sections of the newsletter you may want to skip ahead to…

Win🏅: Getting feedback on my financial model and valuation

Loss 🤕: Freelancer woes; when things go painfully wrong

Hack💥: How to build an investor outreach series in Hunter.io for free

Resources 📚: Lists with investor contact details

As always, I appreciate feedback, so feel free to leave comments or reply to this email with your thoughts.

🎯 Objective

Double down on investor outreach and review initial email results

Six weeks into launching Mane Hook-Up’s funding round, it was time to make sure investor outreach was at its peak. This meant:

Reviewing the results of automations that had been running for two weeks and making any necessary changes.

Doubling down on the automations and processes that work to allow me to reach more of the right investors, faster.

Sounds simple, right? But, what I hadn’t banked on was getting some feedback early in the week that would have an impact on all of the above (in a positive way 😉).

🔋 Progress recap & highlights

Biggest wins

WIN 1️⃣: Getting feedback on my financial model and valuation ✅

With all of the investor outreach I’m doing, I’ve realised that people very rarely give feedback.

And look, I get it.

Investors can share their thoughts on a pitch, deck, or model, but that doesn’t always mean what they think will be well received. This post by Stephane Nasser was quite eye-opening in terms of what people can be on the receiving end of…

Now granted, I have no idea what that interaction looked like on both sides but I can imagine the fear/nervousness of getting responses like this is one of many reasons that investors just send the generic “it’s not you, it’s me” reply.

With this in mind, when I got some feedback on my financial model and valuation from an investor, I was… A) grateful they had taken the time to share (to me, it was a sign that they cared) and B) decided to apply their feedback to see if it could have an impact on other discussions.

And the results were pretty awesome.

Before I get into that, here’s a quick overview of the feedback and what I did with it:

💰 Financial model

Feedback: the model wasn’t tight enough — it needed to be leaner for the stage Mane Hook-Up is in. Some of this was possibly coming from the outsourced work.

Next steps: I spent a day or so reviewing my model and made some tweaks — this meant reviewing outsourced work vs. in-house, hiring plans, department budgets, etc, to see where I could trim down down. While I started by addressing the areas that the investor had raised, I dug into the finer details of the budget and managed to make adjustments elsewhere after noticing some overestimates.

Result: Extending the runway by about 7 months on the same budget.

📈 Valuation

Feedback: Needed to be more in line with current market expectations.

Next steps: I spoke to a couple of people to gather data on the current market. There are also a few people posting about this on LinkedIn regularly, so I reviewed that info too. After a bit of digging (plus the financial model tweaks), I’ve changed the valuation to make sure it is in line with what I had heard and read, but also ensured that I’m happy with it too.

Result: I’m MUCH better equipped to have this conversation with investors and feel comfortable/confident that this is in a better place.

🎣Overall result…

The conversations that I’ve had with investors since have been more fruitful — not only do I have the confidence to engage and justify our model and terms, but the responses have been positive as well. I would go as far as to say that my response rate has increased because of this (more on that in my next win 🎉).

Now, this isn’t to say that I’ll have a chance (or want) to apply all of the feedback I receive from every conversation, but it just goes to show that it’s often worth testing or considering what others have to say. While none of this was expected, it was certainly the most helpful feedback of the week and therefore, the biggest win.

RESPONDING TO FEEDBACK: fundraising can often feel exhausting and, as a Founder, sometimes feedback can be painful (especially when you're putting your heart and money into a product that you really believe in). But it's important to remember that investors who are offering feedback are usually just trying to help. There are cases where investors may be wrong and overstep a mark, but even when that happens, you're much better off taking the high road than engaging in a conflicting back/forth that could ultimatley burn bridges. If you get some feedback that takes you sideways, don't respond straight away. Take a moment, think about it, do some research and apply what you think is worthwhile. WIN 2️⃣: Investor outreach is working (12x email replies, 2x calls booked, 2x warm intros) ✅

Given I managed to collect the details of over 1,000 people and oragnisations, I had to create a system for my investor outreach and landed on this:

Categorise: all investors either fall under A (perfect fit) B (great fit) or C (good fit). From here on out, they’re treated in one of two ways…

Personalise: all emails/messages for A investors are personalised — so I’ll spend 20-30 minutes working on an email, doing extra research on their previous investments/interests, and looking for opportunities to get warm introductions.

Automate: B and C investors are put into email automations that are sent out once every 7-10 days. I drafted 15x email templates (check out my last newsletter) and turned these into various series with subject line and content tests to see what performs best.

Now that my outreach has been up and running for a couple of weeks, I’m starting to get responses and have data from the first set of emails. And things are looking positive so far:

A investors: 80% open rate, 25% reply rate, 8% calls booked

B investors: 40% open rate, 1% reply rate, 0.3% calls booked

C investors: 62% open rate, 6% reply rate, 10% calls booked

While the response has been mixed (e.g. some people reply to politely say it’s not for them), I consider a reply a positive. It means that people are a) opening the emails and b) taking them seriously, none of which is a given.

It’s all data that will help me to better understand what communication strikes a chord with investors and how to best present myself to them. This is super important because I want to have an impact sooner rather than later.

A few other things about the email sends:

Day of week: Sending from Monday to Saturday (1x test over the weekend to see if that’s any different). Not seeing that any day gets more responses yet.

Time of day: Between 9 am-6 pm of the time zone that the person is in. Early morning and afternoon are getting more replies.

Overall, not only has automation saved me a tonne of time, it’s also facilitated plenty of conversations faster. I think this is an area a lot of Founders get hung up on as instinctively you assume the more personalised it is, the better. But with only so many hours in the day, I’d recommend balancing personalisation with automation to get a better result.

TIP FOR INVESTOR EMAILS: if you can't get people to open your email, they will never learn about your product to respond. Despite the subject line being everything, I see more founders focussing on the content of their emails than the subject line 😅. I recommend testing several variations and looking for invetsor email templates online to see what has worked well for others. Also, remember that investors get emails dropping into their inbox on a daily basis. Grab their attention with the subject and they'll be more inclined to read the contents of the email properly. WIN3️⃣ : Collected a lot of ideas on monetising the existing platform ✅

I caught up with a fellow Founder last week and they gave me some incredible advice on monetising my platform (this is just one of many reasons I love speaking to and learning from other people).

They let me in on a concept I had never heard of.

“Duh” pricing.

This means your product is priced in a way that isn’t seen as a loss. It’s not so cheap that it seems like a scam, but cheap enough that there’s no friction with asking for money.

Off the back of this conversation, I’ve created an initial pricing structure that I can test on my community. This also offers another proof point to share with investors when I speak to them.

It’s still a work in progress, but I’m hoping to test this out in the next couple of months and will share the results too!

TIP FOR PRE-REVENUE STARTUPS WHO ARE FUNDRAISING: starting conversations with investors when you're pre-revenue can be tough, but it's not impossible if you have a plan. Having a strong financial model and even 5-10 people who are willing to pay for your product is a start. You do not have to charge them the earth -- start with a pricing model that's simple, and falls under the "duh" strategy. It means that there are a group of people who will pay to have this problem solved, and next you have to prove that you know how to get access to them. WIN3️⃣ : Met some amazing founders virtually and in person ✅

I’ve probably mentioned this in every newsletter so far, but attending events is so important. Meeting people face-to-face gives you a chance to leave a lasting impression and gets you access to more conversations faster. Events have already allowed me to:

Gain more warm introductions with investors

Build up my Founder network

Get opportunities to collaborate/support other brands

As it’s been pretty fruitful for me so far, my plan is to go to one event a week until Christmas (ideally in the evening so I can spend the day powering through outreach and other projects).

Last week, I went to the Curve Clubs founder x investor cocktail event and met some great people (huge thank you to Neda for giving me the heads up!).

While the room was filled with more Founders than investors, I really enjoyed hearing more about their experiences of fundraising and building their platforms/products. Again, this gave me a chance to sharpen my 20s pitch, which seemed to be better than the first event I went to a month ago.

I prefer environments that feel relaxed and informal as they give me a better chance of getting to know people. The more space you have to find common ground, the better as it’s important to find a tribe (whether investor or founder) that shares your values. Something I find corporate/stuffy events don’t really give you the opportunity to do.

That all said and done, two of the people I met last week get a special S/O:

Neda Saheblem: we connected on LinkedIn a month ago and met in person at the Curve Club event on Friday. Thank you for being an incredible connector and knowledge sharer!

Lindsey Lerner: fellow Founder who is on the other side of the world in the USA — we had a video chat on Friday and shared our fundraising woes 😂 thank you for creating a safe space to vent!

Some other things I managed to get done this week:

Our advisors had a call with a potential investor that I’ll hopefully be intro’d to in a few weeks

Got an invite to an event and an offer to be introduced to an Angel investor

Calls with group A, B, and C investors booked in or completed

Amazing call with a freelancer who will be helping with our waitlist/community

Made 5x applications for Angel Syndicates

Great call with an Angel Syndicate leader, but they thought we were too early stage

Is this helpful? Share the 240 Days newsletter with your community.

Biggest L’s 🤕

LOSS 😩: Freelancer woes; when things go painfully wrong

Remember a few weeks ago when I mentioned the power of outsourcing… well this week I’m talking about what happens when outsourcing goes wrong 🫠

I’m all about offloading work that absolutely needs to be done and is either a) too time-consuming to justify my focus or b) I just don’t have the skills to execute.

So, about six weeks ago, an essential but time-heavy project came up that I needed to hand over. I spoke to a couple of freelancers, before landing on a person who was really up for the job.

I shared a brief, ironed out deadlines (4x weeks to hit the objective), and off they went.

The result? Six weeks later, and there has been next to nothing delivered.

Now, I won’t go into all the detail (that would take up an entire newsletter of its own) but here’s a very quick rundown of the issues that we had:

Communication 🤐: when I first suspected there were going to be issues hitting the targets/deadline, I asked more questions and often got a lot of silence or very delayed responses.

Transparency 🪟: all projects have their hiccups and while I never expect things to go 100% to plan, I do ask that people tell me both the good and bad. In this instance, the hiccups and road bumps were not communicated upfront and were typically shared as a result of my digging around.

Asking for more industry context 📚: the afro/curly hair industry is niche and often complex so sharing the knowledge that I and my advisors have is key. While I shared a fair amount during the kick-off call, unbeknown to me, it wasn’t enough. The knowledge gap slowed things down, but again I only knew this after offering to share more on a call.

Promises not delivered ⏰: whether I’ve asked for spreadsheets, data, or a response to questions (or those things have been offered willingly), they have never been given on time.

It’s a lot, I know.

Let me get you up to speed on where we are now. Let’s just say it’s at the point where I’m getting involved to make sure the target is hit. On the upside, I am getting a refund (which is something) and they have taken responsibility for much of what’s happened.

But time (the one thing I can’t get back) has been wasted, and that’s the biggest pain of it all.

Now, I want to make it clear that this is one of the few bad experiences I’ve ever had with a freelancer (it’s anything but the norm). But, the important takeaway is: that the time, energy, and money that outsourcing should save can all go in the toilet if you end up working with the wrong person.

It’s also worth remembering that no one will care more about your business than you do. So what’s more important is working with people who can match your working style, and you set the tone for behaviours that you expect from the beginning.

This wasn’t purely one-sided — I made mistakes too, such as:

I didn’t make my ways of working clear: transparency is a big thing for me. I would rather know a problem is on the horizon than be knocked sideways when it’s finally here. Had I taken the time to ask more ways of working questions vs. results achieved questions, I may have figured out earlier that we were not the best fit for each other.

I definitely didn’t ask enough questions: being short on time doesn’t excuse skipping over areas of due diligence, and I was guilty of that. In my haste to get someone in to do the project, I didn’t think about the repercussions of working with the wrong person (e.g. the time and money impact).

I waited for too long before jumping in: everyone should ideally have a chance to rectify a problem, but there are some cases (especially when timings are key) that you just need to get stuck in. I waited a bit too long to do this, hoping that lighting a fire under them would change the pace (it didn’t 😮💨).

As I wrap up this project, I’m reminded that moments where things go horribly wrong are often where you’re tested to be creative and figure out how to make it work.

QUESTIONS TO ASK FREELANCERS: Balance the questions that you ask between these three groups: examples of results, examples of processes, industry knowledge. If you lean into results, you may miss details about ways of working and industry know-how that are super important to you. 💡 Lessons learned

Quote of the week

Do you want to know who you are? Don’t ask. Act! Action will delinate and define you. — Witold Gombrowicz

LESSON 👩🏾🏫: Understanding the investor landscape/market will help you to close faster

Getting feedback from investors, founders, and mentors has by far been one of the most helpful things that happened last week.

But I’m also aware that, had I paid more attention to the landscape through an investor’s eyes, some of my earlier conversations may have ended very differently. This has made me realise how important it is to adapt to the market as you raise.

That isn’t to say that you should be changing things every 5 minutes or with every round of feedback that you get. But, in a world like the one we live in now (where financially things have been on fire for a while 🫠), adapting with new information in mind is key to closing.

I caught onto this later than I would have liked, and want to make sure you are a step ahead. So, if you’re looking for some info on what the market looks like right now, here are some great people on LinkedIn to follow or posts to read:

💥 Hack of the week

How to automate investor outreach using Hunter.io (for free)

Investor outreach will quickly make you realise there aren’t enough hours in the day to work on a 100% personalised email for everyone, let alone send follow-ups and replies.

That’s where email automation comes in 🤓.

With the right tool, you can set up an email series that automatically sends messages to your investor contact lists. Leaving you with the task of following up with anyone who is interested.

There are also plenty of automation tools, but few that can be used for free.

Hunter (in my opinion) is the best free email systems around as you can:

Connect it to an existing email address

Have unlimited contacts saved in your account

Send email series to a max of 500 people at a time on the free plan (which is plenty)

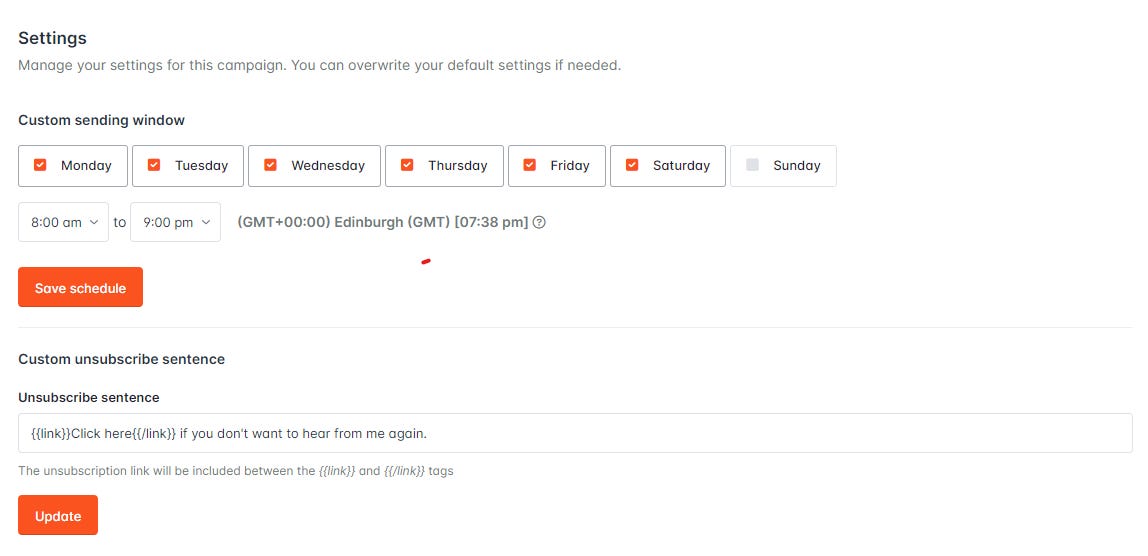

And it doesn’t take long to set up, all you have to do is:

Head to the ‘Campaign’s section of Hunter and click ‘New campaign’

Give the series a name that makes sense (e.g. Angel Investors | USA | Perfect fit)

Create the content for each email — include personalisation (like first name and company name). Bear in mind you can’t add any attachments to an email in the free version of Hunter, but you can add links. So, make sure you have a URL to your deck that can be shared with investors.

Decide how often you want them to receive an email — 7 to 10 days is the sweet spot.

Make sure everything is being tracked — select open rate tracking and make sure the unsubscribe link is also added to your emails (tick the options at the bottom)

Upload your contacts list — use a CSV file to add all of the people to the email series (remember, you can send to a max of 500 people per automation).

Update the settings — choose the days (ideally Monday to Friday) and time range you want the emails to be sent. Be careful to take the time zone into consideration. For example, if I’m messaging investors in the US, I’ll set my series up to send emails between 4pm and 8pm GMT. You may be better off splitting investor lists by location to make life easier.

Finally, review the emails before hitting send — Hunter allows you to preview all of the emails being sent in a series and make tweaks to each individual email (if there are any small touches you want to make for specific investors).

And there you go, seven steps to getting all of your investor outreach automated. Test it out and let me know how it goes!

📚 Resources

If you made it all the way to the end of this newsletter, you deserve a reward. So here’s a list of the best resources I came across last week to help you with your raise.

Lists with investor contact details

🧰 Founder’s toolbox

Anyone who knows me knows that I love finding tools, apps and systems to add to my arsenal. Each week, I’ll share 1-3 tools that I’ve added (or removed) from my toolkit and, hopefully, they’ll serve you well too. Here’s a list of the best tools that I found last week…

Sydecar SVP set-up

What’s it for: Platform that allows Founders to set up SVPs for fundraising.

How it helped: Also shared with me by an investor, Sydecar allows you to create an SVP, which is a way of pooling money together from investors immediately rather than gathering money at the end of the raise.

Price: 2% of the total fund ($1k fee to terminate)

Rating: haven’t used them but had a demo + spoke to the team, worth looking into!

Start-up valuation calculator

What’s it for: Help founders to quickly see pre and post-money valuations.

How it helped: Allowed me to quickly review a bunch of scenarios when I started tweaking my financial model and helped me to land on something that I and my team are happier with.

Price: Free online tool

Rating: 5/5*

Questions? 🤔

Feel free to drop any questions in the comments below! Until next week,

J x

P.S. Here are some of my other posts:

P.P.S. Enjoy this newsletter? Subscribe and please share with a friend who could benefit from reading it!

Such a great read! I’m in the trenches on a fundraise right now and can totally relate to all of this. Appreciate the hacks and tools too! Good luck with the investor calls 💪🏼