2023 in review: lessons, hacks and resources for Founders who are fundraising now

A recap of the the best lessons and gains from 2023.

Hey there 👋🏾,

Happy New Year all!

First of all, a big thank you to everyone who has been following my fundraising journey so far. We’re just three months in and so much has been achieved, such as:

240 Days posts have been read 2,565 times, which is a huge milestone 🥳

Newsletter subscribers have increased by 223% & my LinkedIn followers by 22%

Founders and investors have connected with me after reading some of these posts

Hopefully, that’s a sign that sharing a play-by-play of Mane Hook-Up’s funding round has been helpful and I’m looking forward to continuing the journey in 2024!

But, before I throw myself back into the round, I’d like to take a moment to reflect on some of the biggest lessons learned, wins achieved, as well as resources and tools used last year.

That said, here are the sections of the newsletter you may want to skip ahead to…

Lessons 💡: Cold outreach works (often in unexpected ways)

Wins🏅: 27x calls with investors, 41x Angel Syndicate applications made, 7x events attended and endless offers of support

Hacks💥: 6x fundraising hacks to help Founders in 2024

Resources 📚: 13x resources to help Founders in 2024

Toolbox 🧰 : 9x tools that are helping me to power through my funding round

As always, I appreciate feedback, so feel free to leave comments or reply to this email with your thoughts.

💡 Lessons learned

Quote of the quarter

Don’t be afraid. Be focussed. Be determined. Be hopeful. Be empowered.

— Michelle Obama

LESSON 1 👩🏾🏫: Cold outreach works (often in unexpected ways)

I hear a lot of investors and Founders warn people off of cold outreach, but after doing this myself, I can wholeheartedly say it is worth the time of day.

While I have yet to close a from cold outreach, it has led to:

400% increase in our investor update email list

5x warm intros with other investors (with more pending)

1x referral to an Angel Syndicate

2x relevant industry introductions (with one potential new advisor)

50+ no’s from people who are not interested or no longer investing (saving me a shed load of time chasing these people up)

These are all huge wins and beneficial to Mane Hook-Up now and in the future.

It’s highly unlikely that I would have had the time or capacity to reach out to all of these people, had I been waiting for warm introductions. And it has, to some extent, put me on their radar.

Fundraising, to me, is not just the act of closing an existing round, but also opening the doors and opportunities in the future by building connections in the right places. Cold outreach has enabled me to do so, and I think this shouldn’t be overlooked by Founders who are raising right now.

TIP FOR COLD OUTREACH: Sometimes it's hard to know how many times you should reach out to someone you don't know. I has a spike in responses from email 3 to 7 in my email series, so that may be the sweet spot. Remeber, someone has to see your name 4 to 6 times before they're prepared to take an action so be patient and don't be afraid to keep following up. LESSON 2 👩🏾🏫: You are not at the top of everyone’s priority list… be patient

Everything can feel urgent when you’re fundraising.

You’ll start doing outreach and want calls to roll in after a few days.

You’ll have calls with investors and want to book follow ups in a week.

You’ll get to due diligence and want to fly through that as well.

But the sense of urgency that Founders have is rarely reciprocated on the other end, and that’s not necessarily a bad thing, it’s just something that you have to accept when you’re in the midst of fundraising.

I’ve wondered if investors are really interested, been convinced that others where ghosting or had long forgotten about my pitch… only to have an email land in my inbox in a few weeks, when the time was right for them.

Urgency stems from being a priority. And, as much as it would be amazing to be at the top of everyone’s list, that will rarely happen when you’re in the middle of a round and you’re competing for a space in someone’s calendar.

I’ve learned not to take this personally, but to just treat outreach and follow-ups in a more methodical way: after sendinging a message, I follow up in 7-10 days.

By shifting the focus away from an expectation and toward a task, I’m able to exercise more patience (without overthinking). Not an easy task, but it’s well worth remembering that your high priority may not be theirs. Give it time, and don’t be afraid to keep following up.

TIP FOR OUTREACH: Instead of trying to book calls in via email, ask investors when they're next available to speak at the end of a call. This will save you a lot of time and headspace having to chase up. LESSON 3 👩🏾🏫: Find a balance between fundraising and operating the business is key

Investors are ultimately interested in how your business is performing.

That often translates to ‘what does your traction look like?’.

A few years ago, the concept of traction for a pre-seed start up was very different to what it is now. Questions that would have been largely based on a waitlist numbers, social following, press coverage or initial product build, have now changed to customers and revenue.

And, while I don’t necessarily agree with everything in this shift, it’s not something that can be ignored.

Which is why it’s important, now more than ever, to find a balance between fundraising and operating my business. And, that has only come from having a small team to share the load with.

As tempting as it can be to go full speed ahead on focusing on fundraising alone, I’ve had to remind myself that part of objection handling and assurance for investors comes from traction.

So, in 2024, I will be spending as much time thinking about my product as I will about the raise.

TIP FOR FINDING BALANCE: You need people to offload day-to-day business tasks to while you're raising. Whether you find a relaiable freelancer or an intern, having an extra set of hands (or two) will be key if you want to maintain that groth while you're raising.Is this helpful? Share the 240 Days newsletter with your community.

Biggest wins of 2023

WIN 1️⃣: 27x calls with investors, 41x Angel Syndicate applications made, 7x events attended and endless offers of support 🌎

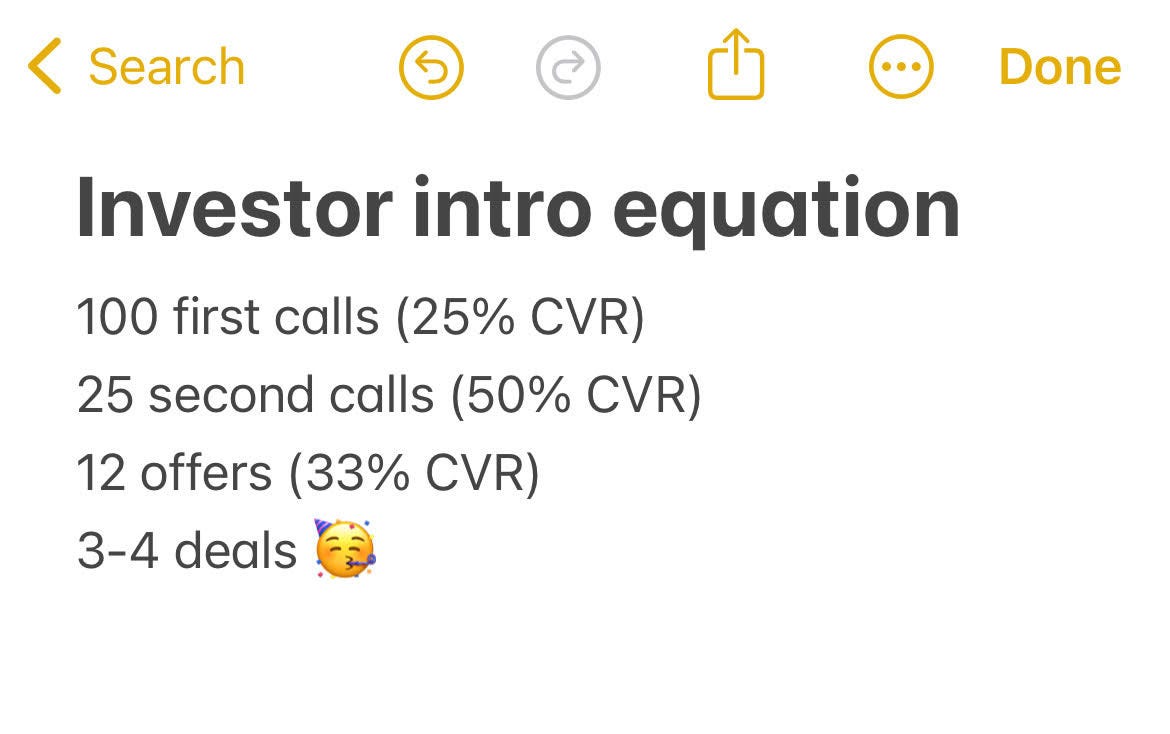

Before kick-starting investor outreach in October, I tried to map out how many calls or interactions I needed to close the round. This was based on feedback from other founders and any research I could find online, but here are the numbers 👇🏾

It was with these numbers in mind that I challenged myself to reach as many relevant investors as possible. This was done through a combination of:

Attending events and meeting investors directly

Cold email outreach and warm introductions

Applications made for Angel Syndicates in Europe, USA, South America, Canada and Africa

Honestly, these numbers pushed me to find more investors to speak to. While it was a slog to get those 27 calls booked, the target kept me centred and even led me to some of the most strategic pivots of my outreach strategy (e.g. reaching out to Angel Syndicates in different parts of the world).

WIN 2️⃣: Finding my founder tribe 🫎

It really does take a village to go through a funding round.

And, this is especially true for solo founders. As I work on building Mane Hook-Up, managing a small team and building relationships with investors, it is the Founders in my network who prop me up and keep me sane.

I’ve experienced more emotions in the past three months than the changes to British weather in a day. From the thrill of starting to work on Mane Hook-Up full-time to the lows of burning out and coming to terms with the many rejections, my highs and lows were regulated by the Founders I spent most of my time speaking to.

Finding a group of people who are cheering from the sidelines has been one of my biggest wins, and I highly recommend that Founders take the time to find a community of people they can rely on as well.

It makes a huge difference to the experience. And, after all, the journey is only as good as the company that you keep while you’re on it.

TIP FOR STAYING IN TOUCH WITH YOUR TRIBE: Connecting with new people is one thing, but keeping in touch is challenging when you're constantly on the move. Relationship management tools and CRMs are a great way to make sure you are maintaining those relationships with people. Highly recommend using Dex (also featured in today's toolkit summary). WIN 3️⃣: Launching cold investor email outreach with email automations 📧

Unpopular opinion: automating your investor outreach is efficient, not lazy.

With the number of people I need to speak to, there just isn’t enough time to personalise everything. And given the quicker you close a round, the quicker you can also get back into building your product, I also believe there’s merit to saving time by using automations.

In my opinion, you need some solid email templates, a convincing proposition, data that validates your product/market and a simple CRM that helps you keep track of every interaction.

That was my approach for much of 2023 and (as well as helping me to secure a bunch of intro calls and event invites), they gave me more time and headspace to prepare for other things.

Here’s a snapshot of how the automations performed:

🤖 Launched 12x automations (testing subject lines, sending times and days sent)

👯🏽 Added 1,953 people to those automations (sending 1x email every 7-10 days for 2-3 months)

🏓 Around 380 hard bounces (and removed them from my CRM)

📧 1,206 people have opened my emails (78% of remaining contacts)

↩️ 120 or so people have replied so far (9.95% of contacts)

For context, the average email open rate is 21% and the average reply rate is 8%.

My automations have a higher-than-average performance and have led to some fruitful outcomes. People often turn their noses up at cold and automated outreach, but I think there’s a power to this process (when it’s done right).

TIP FOR RUNNING AUTOMATIONS: Do your research and look for email templates for investor outreach before building an automation. Better to take inspiration from someone who has closed a round from cold outreach, than start from scratch yourself (there are some templates in the resources section of this newsletter). 💥 Hacks of the year

Here’s a list of the best fundraising hacks I shared in 2023.

How to find investor contact details on Crunchbase (without paying a dime)

What to consider when you’re paying someone to build an investor outreach list

How to find customers in Reddit groups and speak to them about problems

📚 Resources of the year

If you made it all the way to the end of this newsletter, you deserve a reward. So here’s a list of the best resources I came across in 2023 to help you with your raise.

Templates

The Investor Research template that I created to information gather and prioritise the investors I get in touch with. It’s a Google sheet that you can just duplicate and use in your own time.

Angel investor lists

Warm intro advice

Valuations

Investor outreach email templates

Pitch deck template support

🧰 Founder’s toolbox

Anyone who knows me knows that I love finding tools, apps and systems to add to my arsenal. Here’s a list of the best tools that I found in 2023 (all of which have become permanent members of my toolkit).

For managing relationships

Dex: This is my tool of the year. Dex helps you to manage all of your key relationships from one place. Connect your inbox, calendar, LinkedIn profile and phone contacts list to gather all of your data in one place. From there, you can set communication reminders (weekly, monthly, quarterly etc) and leave notes on every interaction that you have. This is brilliant, not just for investor relationship management, but for community management as well.

For investor outreach

Wobaka: A simple CRM I’ve used for all of my investor outreach. Highly recommend it for Founders who need a CRM but don’t want to spend the Earth on a system.

Hunter.io: Another CRM and automation tool that can be used for investor outreach. Hunter is more expensive than Wobaka, but it also has more features (e.g. email verification).

Skrapp: Email scraping tool that allows you to collect people’s email addresses from LinkedIn in a couple of seconds. You can gather 50 emails for free a month.

For creating a pitch deck

Slidebean: A presentation/deck design tool that has templates that can be re-used/followed. Slidebean also has a consultancy that helps Founders design and create quality decks.

Pitch.com: Another presentation/deck design tool that has plenty of templates that can be used.

For managing your time and meetings

Intelligent Change Productivity Planner: As someone who is guilty of setting lofty goals and not always planning my time precisely, this planner has saved me a shed load of time and helped me achieve A LOT. It helps you to set goals, and plan your days, weeks and months to gradually get there. I reckon 50% of my achievements from last quarter came down to planning my time more efficiently by using this system. I highly recommend it to anyone who is running a business or raising right now.

Reclaim.ai: A time and calendar management tool that effectively helps you block out time to deliver tasks and projects to schedule.

Fathom: A free video call transcriber and video recorder. There are plenty of these on the market, but Fathom is the only one I could find with a free model and unlimited storage.

Questions? 🤔

Feel free to drop any questions in the comments below! Until next week,

J x

P.S. Here are some of my other posts:

P.P.S. Enjoy this newsletter? Subscribe and please share with a friend who could benefit from reading it!